How to do a GRI 3(b) or 3(c) sets entry

in the system:

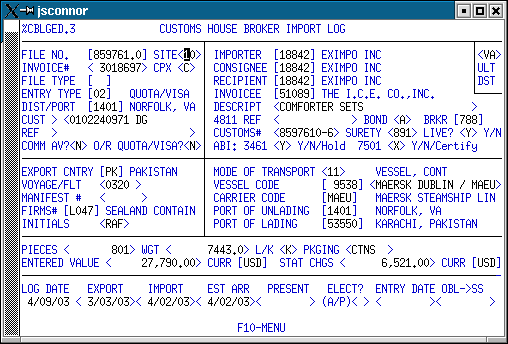

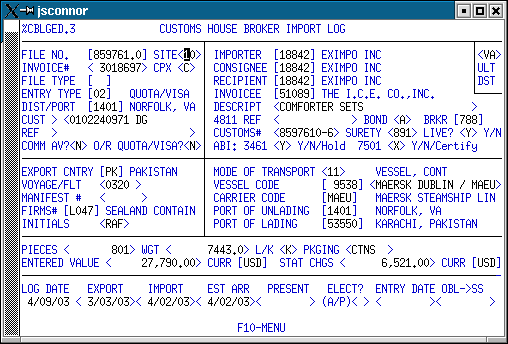

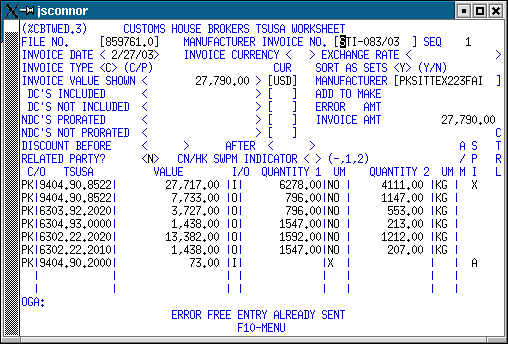

1) Log the file as usual.

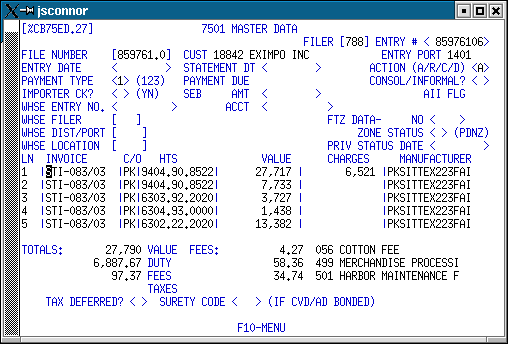

2) Go to the worksheet.

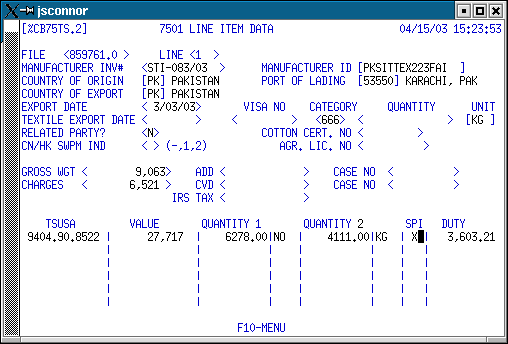

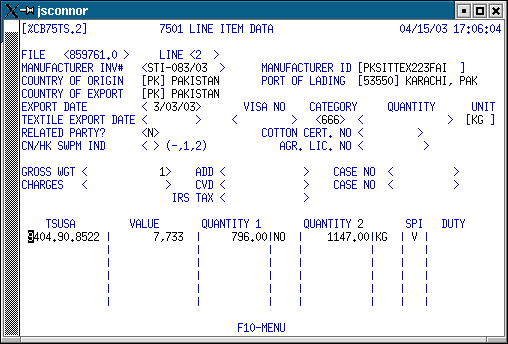

In this

example the set is a "Bed in a Bag", consisting of a

comforter, curtains, sheets, pillowcases, and a bed ruffle. The

duty rate is determined by the comforter.

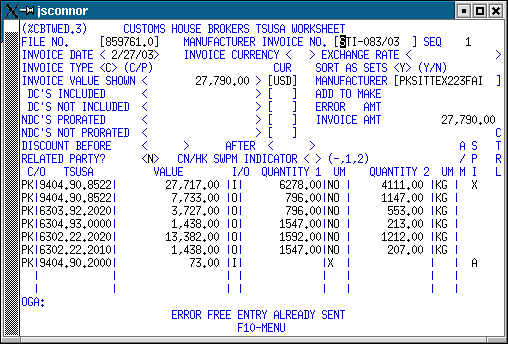

2a) Enter a

'Y' in the SORT AS SETS field.

2b) Enter the HTS number

that determines the duty rate for the set (9404.90.8522), the value

of the entire set, and any required net quantities.

2c)

Enter the HTS number, value, and quantities for each component

of the set. Note that the HTS number that determines the duty

rate is repeated but shows only the value/quantity of the specific

component that falls under that HTS number. Enter an 'O' in the

I/O field to keep invoice total in balance.

For this example

$27717 is the value of the entire set.

9404.90.8522 is the

comforter,

6303.92.2020 are the curtains,

6304.93.0000 is the

bed ruffle,

6302.22.2020 are the sheets, and

6302.22.2010 are

the pillowcases.

2d) Enter any other HTS numbers or

additional invoices, as required.

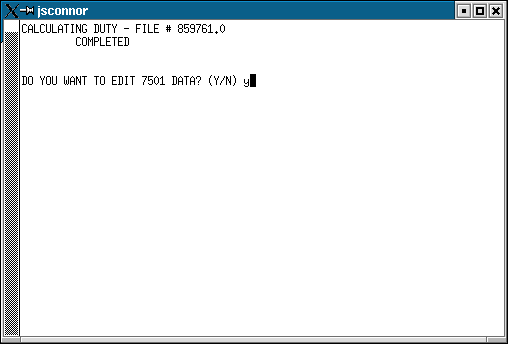

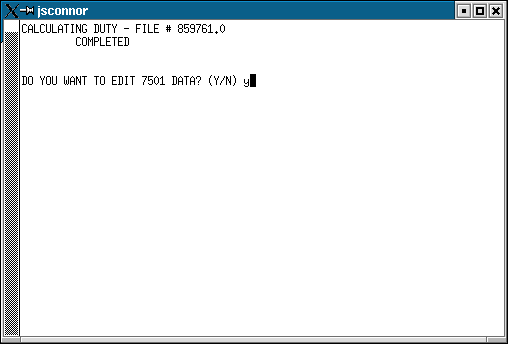

3) Calc the duties with F7 key.

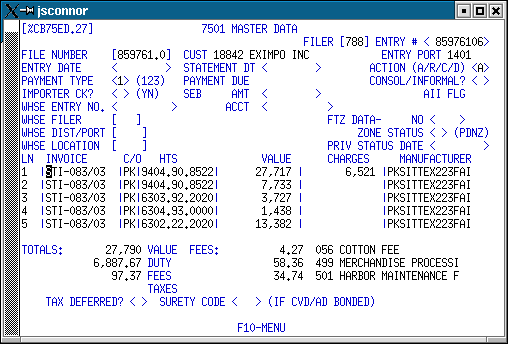

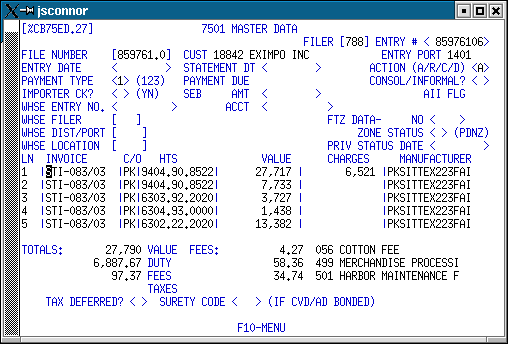

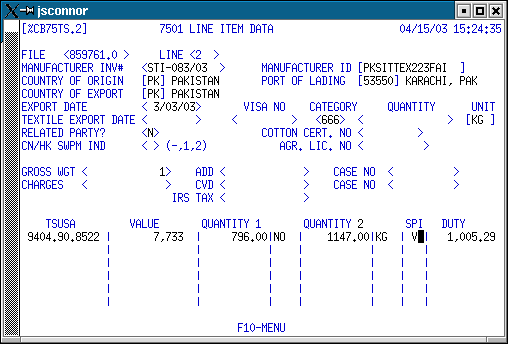

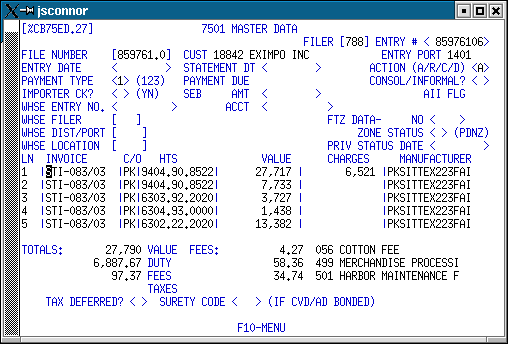

4) Then go to the 7501 Master Data Screen.

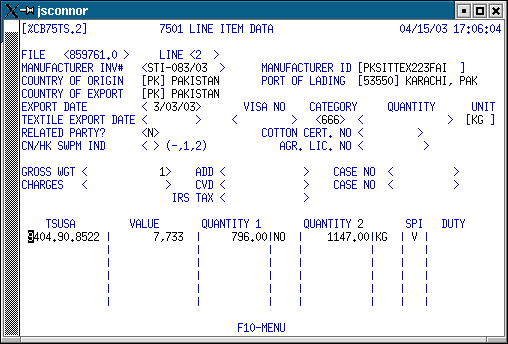

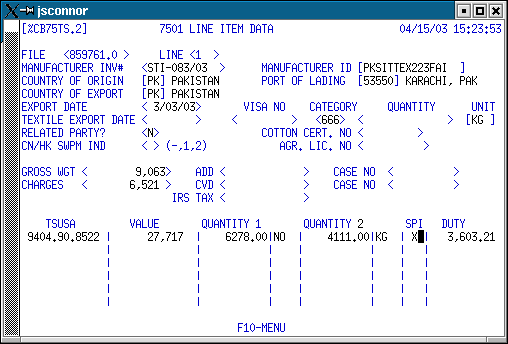

5) Place the cursor on the sets line item that has the

full set value, then press F8 to open the Line Item Detail

screen.

Enter 'X' in the SPI field to indicate that this line

item contains the header information for the set. Press the

Enter key, then F1 back to the 7501 Master Data screen.

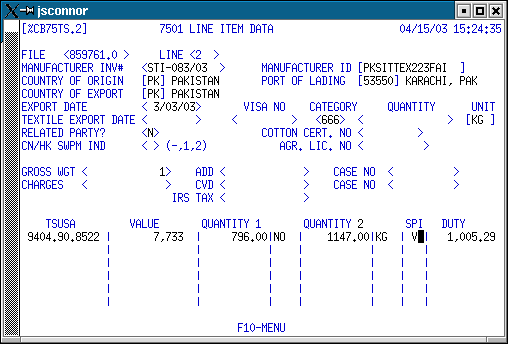

6) Place the cursor on the line item of the first

component of the set the press F8 to open the Line Item Detail

screen. Enter a 'V' in the SPI field to indicate that this line

item is a component of the set.

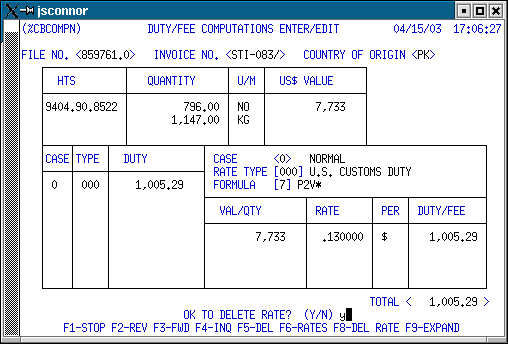

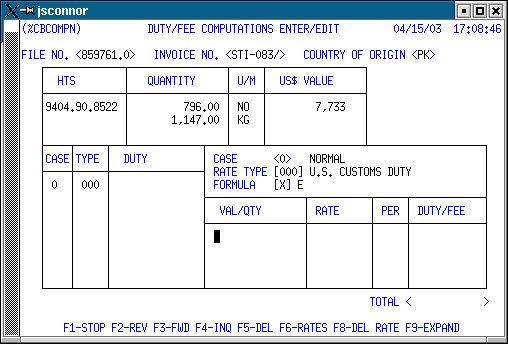

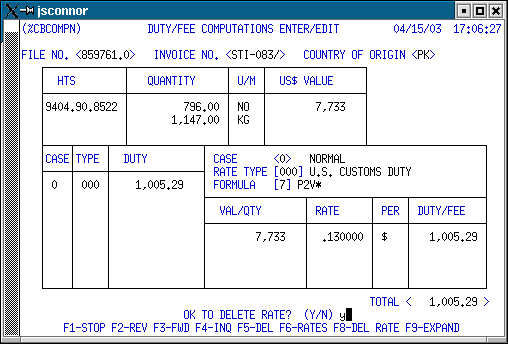

7) Press F8 to open the Duty Computation screen. With

the cursor on the duty line in the lower left portion of the screen,

press F8 again, then answer 'Y' to delete the rate.

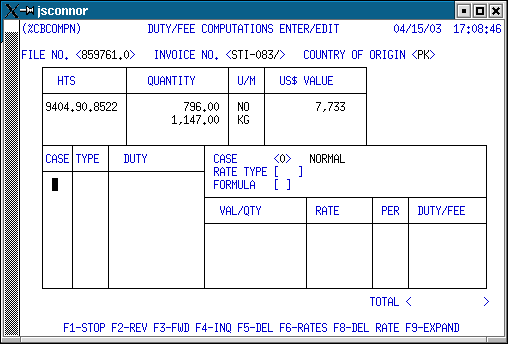

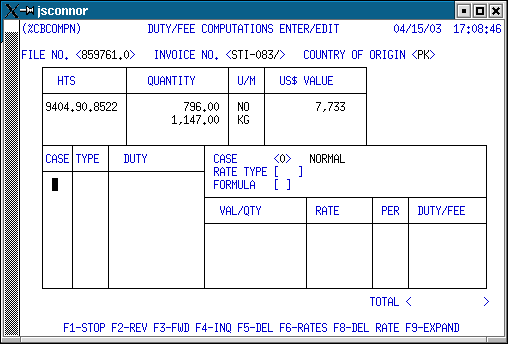

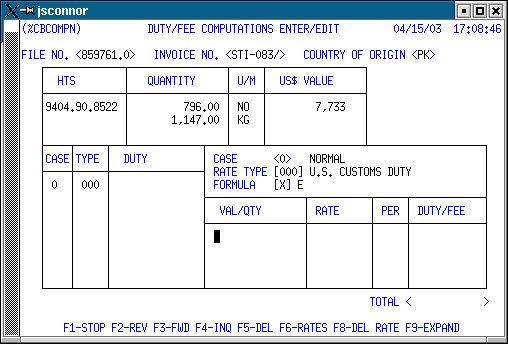

7a) To properly format the ABI record, you must add a

zero duty amount.

7b) Enter '0' in the CASE field, '000' in the TYPE

field, then press F9. Press the Enter key. Press F1 to

return to the Line Item Detail screen.

8) Press the Enter key to erase the duty amount.

9) F1 back to the 7501 Master Data screen.

10) Repeat Steps 6 through 9 for each component in

the set. Add the 'V' in the SPI field and delete the duty.

Only delete duty amounts. Fees and/or taxes are still

payable on each component line item.

11) When you have

completed the input, press F9 at the 7501 Master Data screen to

recalc the duty totals.

12) Upload to USCS.

Note on sets with OGA requirements

Since

the X/V sets classifications require duplicate input of HTS numbers,

any OGA requirements associated with those numbers must also be

entered and transmitted to ABI.

If the set

classification which determines the duty rate has an FDA requirement,

so does at least one component in the set. ABI requires the

sets classification to be entered twice. Once as the complete

set for duty purposes and again as one of the components in the set.

ABI also requires that FDA data be sent on all HTS numbers with an

FD2 flag.

Attempts to transmit the entry with FDA info on just

the sets classification and not on the components results in entry

rejection.. Submitting the entry with FDA data only on the

components also gets rejected. The only way the entry is

accepted by ABI is if FDA data is entered both on the sets HTS number

and the component HTS numbers.

ABI bypasses value, quantity,

quota, visa, and category edits on the sets line item, but not the

OGA requirement.

FDA

data elements are part of the Cargo Release selectivity process. The

sets classifications under GRI 3 B or C are used only at the Entry

Summary level and are essentially for duty computation purposes.

Ordinarily, it makes a lot of sense to to certify for

selectivity via the Entry Summary data. This method usually

eliminates some double data entry of HTS information. But with

sets entries with OGA requirements there is potentially more data

entry involved in certifiying off the summary, since you have to

satisfy the OGA requirement for the classification that determines

the duty rate and re-key that same information for the component(s)

of the set.

FDA has indicated that they don't want to see

information duplicated (although Customs requires it). You can

satisfy FDA and probably reduce your keypunching on these entries by

certifying from the 3461.

Basically, you just fill in

the log screen info as you normally do with the following

changes:

1) Put a 'Y' in the 3461

field and 'Y' in the 7501 field.

2) Fill

in the HTS number screen (use F8 from the main log screen). You

associate FDA info with your tariff numbers on this screen. There

is no requirement to repeat tariff numbers for sets at this point.

You can attach as many FDA lines as needed to a tariff number,

even across multiple invoices if the MID and C/O are the same.

3) Upload the 3461 data.

4) After

the entry is certified for selectivity, go the the worksheet as

normal. Double the sets classification, calc, and manipulate on

the 7501 Master Data screens with the X/V info as you are currently

doing. Since selectivity has already been performed, there is

no requirement to even input the OGA data. ABI ignores all OGA

(except FCC) data that is transmitted with the 7501 data.

5) Upload the 7501 information.